Begin by paying all of your bills in time each month because a late payment can negatively effect your credit score. And prevent having out too much credit card debt, which might also decrease your rating.

Look for a cosigner. Think about finding a cosigner by using a stable credit rating rating in case you’re not able to qualify on your own. “Lots of lenders will supply loans When they are guaranteed by another person with great credit,” Sullivan claims.

3rd-Bash Brand Mentions: No manufacturers or products talked about are affiliated with SoFi, nor do they endorse or sponsor this article. 3rd-bash trademarks referenced herein are house of their respective proprietors.

A further method that can cause you to more beautiful to lenders is to pay for down your financial debt. This can support Develop your credit rating score, and it'll also decreased your credit card debt-to-money ratio, which measures just how much financial debt you've compared to your profits.

You could make one regular monthly payment to your credit counselor, who'll distribute the money to the card issuers. Nonetheless, you might require to shut your charge card accounts.

If you find data or calculations you believe to become in error, remember to Speak to us. Advertised charges and phrases are issue to change all of sudden.

Should you increase your credit score score before implementing, it's possible you'll qualify For additional desirable loan conditions. Look at gives from multiple lenders and prequalify if at all possible to locate the best deal. Individual loans could be a handy way to protect the cost of significant costs or consolidate bank card debt. Making use of with a FICO score between 670 and 850 frequently qualifies you for competitive interest charges and loan terms.

When it may consider months for the credit rating to jump to your good selection, your effort should pay off in time. Stay diligent and centered on the credit score rating you need.

“Any lender working in these loans expects a lot of defaults and losses, and acts accordingly. The end result is the fact a personal loan is nearly always 550 cash loan a foul offer for The customer with poor credit rating.”

If you cannot get a personal loan with lousy credit, take into account redirecting your initiatives toward strengthening your credit score score. When your credit profile has enhanced, reapply for just a loan.

Lessen revolving account balances. Should you have credit card and revolving credit rating line debt, paying out down your balances could reduce your credit rating utilization and help transform your credit history scores. This may be A fast approach to help your credit scores when you currently have high credit rating utilization.

Friends and family: In case you are in the jam and wish help with a one particular-time Invoice, obtaining a modest loan from close friends or close relatives may very well be a possibility.

Generally speaking, the lessen your credit score, the upper your probabilities of obtaining a lender's optimum advertised fee.

Borrow cash from a loved one or friend. A member of the family or Mate may be ready to lend you dollars with a far more favorable price and term than a traditional lender.

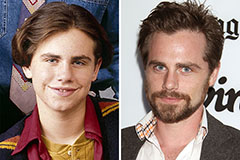

Rider Strong Then & Now!

Rider Strong Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now!